| |

| |

How to Import Bookkeeping Ledger Entries from CSV or OFX

OverviewThis tutorial explains how to import bookkeeping ledger entries into StudioCloud from a CSV file or from an OFX file. How to Import Bookkeeping Ledger Entries from CSV or OFX- Click on the Bookkeeping component

- Click on the Accounts tab

- Click the Accounts menu bar button

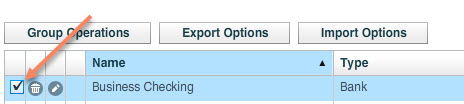

- Select the checkbox for the account you want to import the entries into

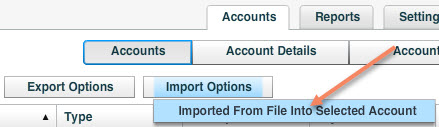

- Click the Import Options menu

- Select the Imported From File Into Selected Account menu item

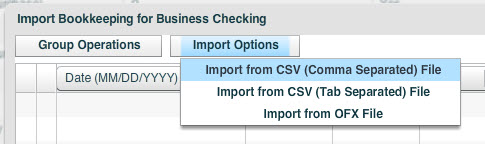

- In the Import Bookkeeping window click the Import Options menu

- Select the Import from CSV (Comma Separated), Import from CSV (Tab Separated), or the Import from OFX File menu item

- The Import from CSV (Comma Separated) is the most commonly used format.

- Browse for and find the file you want to import and click the Open button

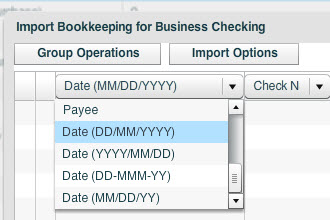

- Verify that the information looks correct. If the information does not look correct then please adjust the columns so that the columns match up to the correct information

- Click the Save button

Expected CSV (Comma Separated) FormatStudioCloud is expecting the csv file to have the following information in the csv file. The csv file might also contain additional information then what is listed below. In that situation you would want to set the additional column headers to blank. - Date format where the date is in one of the following formats

- MM/DD/YYYY

- DD/MM/YYYY

- YYYY/MM/DD

- DD-MMM-YY

- MM/DD/YY

- Check Number

- Notes

- Debit

- This column might also be a Debit/Credit or a Credit/Debit column if the columns income and expenses columns are merged together. Refer to the Debit/Credit section below if they are merged together.

- Credit

- This column might also be a Debit/Credit or a Credit/Debit column if the columns income and expenses columns are merged together. Refer to the Debit/Credit section below if they are merged together.

- Payee

Debit/Credit vs Credit/DebitThe Debit/Credit and Credit/Debit fields are used when both positive and negative amounts are stored in the same column. Debit/Credit - If the amount is less than 0 then this will be treated as an expense. If the amount is more than 0 then this will be treated as an income.

Credit/Debit - If the amount is less than 0 then this will be treated as an income.

If the amount is more than 0 then this will be treated as an expense.

|

| |

|