| |

| |

How to Create/Edit and Use StudioCloud's Gift Card System

Overview

This tutorial explains how to track the purchase of a gift card by a client as well as how to track the gift card balance. DisclaimerSales tax is usually applied to a gift card when the gift card is redeemed. The instructions below assume that this is the case. Check with your local laws to verify this. How to Invoice a Customer for a Gift Card- Create a new invoice

- Add a tax exempt product to the new invoice.

- StudioCloud recommends calling the tax exempt product "Gift Card".

- You will need to create this product in StudioCloud if it doesn't already exist.

- Add a payment for the gift card to the invoice

- If your state/province charges sales tax when a gift card is redeemed select the 'Non-refundable Deposit/Retainer' checkbox to exclude the payment from the sales tax reports.

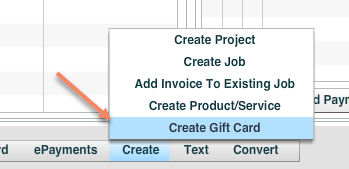

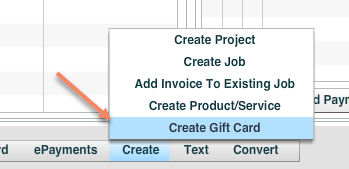

- Click the Create menu bar in the bottom left

- Click the Create Gift Card menu item

How to Redeem the Gift Card in the invoice- Create a new invoice

- Add the items to the invoice the customer is ordering

- Add a payment to the invoice

- Select the "Gift Card" payment method

- If you do not have a gift card payment type you can create one by follow the instructions in the tutorial below.

- Click here for instructions on how to create/edit payment types

- Enter the payment amount

- Click the Select Gift Card button and select the gift card

- Click the Process Gift Card button to reduce the gift card balance by the payment amount

- Click the Save button

How to Create/Edit A Gift Card From The Gift Card Manager Window - Click on the Point of Sale component

- Click the Settings tab

- Click the Manage Gift Cards button

- Either click the New Gift Card button or edit the desired gift card

How to Create a Gift Card From an Invoice - Click here for a tutorial on how to create or edit an invoice

- Click the Create menu bar in the bottom left

- Click the Create Gift Card menu item

|

| |

|